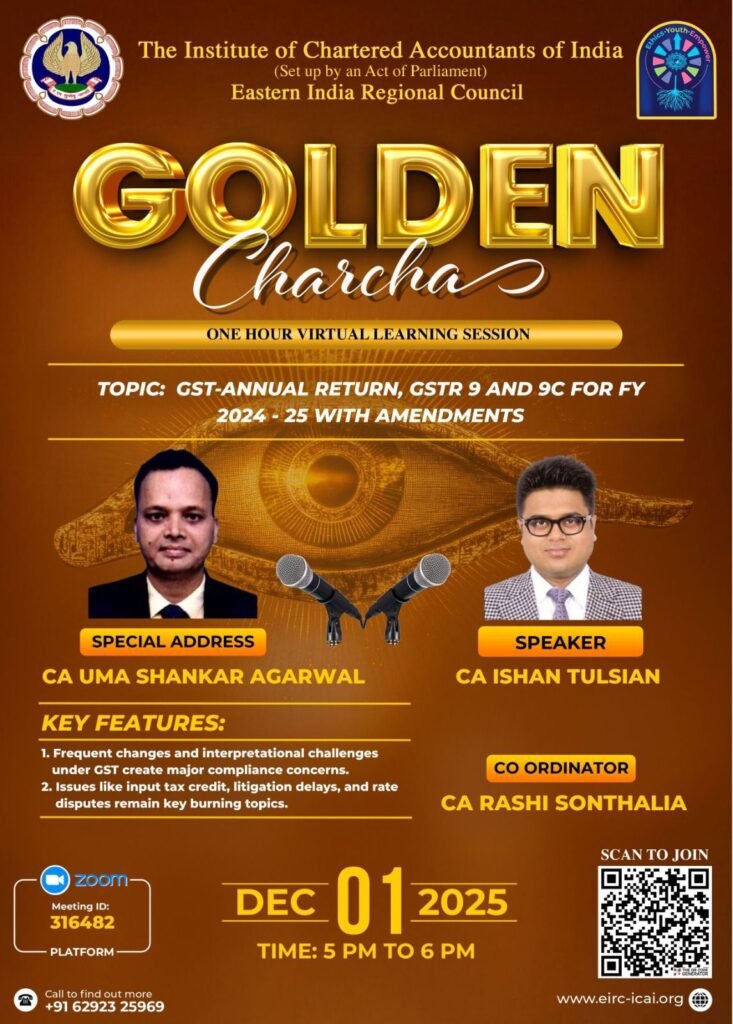

This technical session under the Golden Charcha series, organised by the Eastern India Regional Council (EIRC) of ICAI, focused on GST Annual Return – GSTR-9 & GSTR-9C for FY 2024-25 (with Amendments).

The session was conducted by CA Ishan Tulsian on 1st December 2025, with the objective of providing professionals and businesses with clarity on recent amendments, revised formats, and reconciliation requirements applicable for the financial year 2024–25.

The session offered practical, case-based insights into annual GST return filing and compliance, helping participants understand critical changes and apply them effectively in real-life scenarios.

🎥 Session Recording:

🎯 Why You Should Watch This Video:

This session delivers a structured understanding of amendments introduced in GSTR-9 and GSTR-9C for FY 2024–25. It is especially useful for professionals and businesses seeking practical guidance on revised reporting requirements, reconciliations, and compliance accuracy.

Key takeaways from the session include:

- Key amendments in GSTR-9 & GSTR-9C for FY 2024–25

- Detailed walkthrough of revised return formats

- Case-based reconciliation scenarios and solutions

- Compliance insights to avoid mismatches and notices

- Best practices for accurate year-end GST filings

The video recordings of the sessions are shared solely for the purpose of knowledge dissemination and to assist taxpayers in the accurate filing of GST Annual Returns and Reconciliation Statements in Form GSTR-9 and Form GSTR-9C.

In case of any queries or clarifications, please feel free to contact us.