Our Partner, CA Ishan Tulsian being felicitated for conducting a Workshop Session on GST Amendments at EEPC India for exporters on 09.01.2025

🚀 Workshop on Recent Developments in GST – Strengthening Procedural Safeguards 📊 We were...

Our Partner, CA Ishan Tulsian being felicitated by EIRC ICAI for his deliberation on GST Scrutiny and other recent GST Amendments on 03.06.2024

🎖️ CA Ishan Tulsian Felicitated by EIRC ICAI for His Expert Deliberation on GST Scrutiny & Recent Amendments 📜✨ We are...

Our Partner, CA Ishan Tulsian being broadcasted live for his analysis on Union Budget 2024 on Tazaa TV on 23.07.2024

🎤 CA Ishan Tulsian Featured on Taaza TV’s Expert Panel for Budget 2024 Analysis 📺✨ We are proud to announce that our Partner, CA...

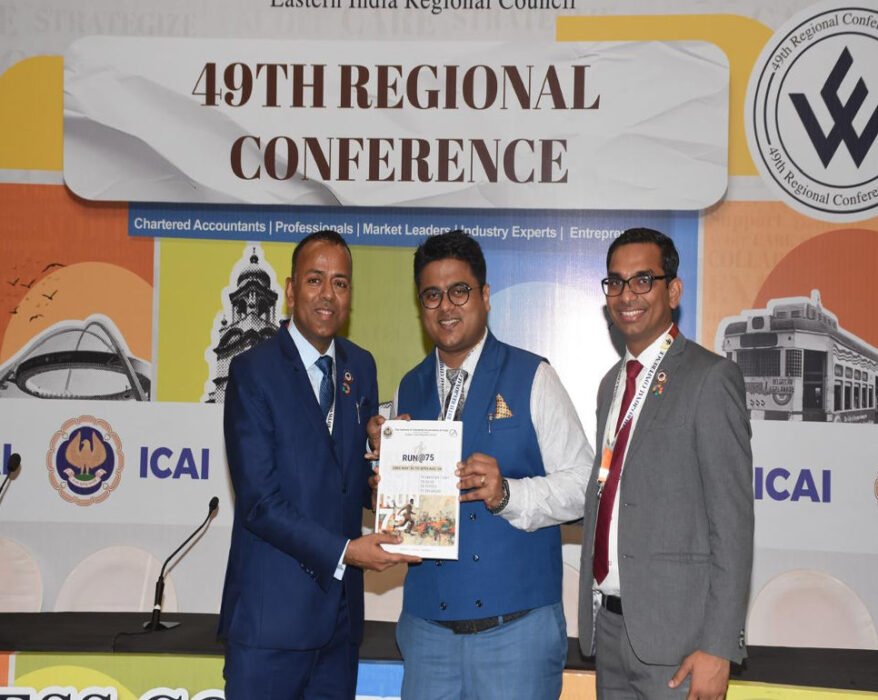

Our Partner CA Ishan Tulsian being felicitated for his contribution as a speaker and author at the 49th EIRC Regional Conference in August 2024

We are deeply honored and grateful to EIRC, ICAI for recognizing our esteemed partner, CA Ishan...

Our Mentor, Advocate Bajrang Lal Tulsian being felicitated by Income Tax Bar Association (ITBA), Kolkata- the oldest ITBA in India on completing 60 years of legal practice at the Centenary Year event.

A Tribute to Excellence: Shri Bajrang Lal Ji Tulsian Honored by ITBA Calcutta With profound humility and immense gratitude, we are honored...

Earnings before Interest, Taxes, Depreciation, and Amortisation (EBITDA) An Overview’ has been published in The Chartered Accountant Journal of February 2023

We are delighted to share that our article, “Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): An Overview,”...

Analysis of how to reply to notices of reversal of Input Tax Credit when supplier has defaulted in payment of Output Tax Liability” published in the NIRC ICAI Newsletter for the month of May, 2022

How to Effectively Respond to ITC Reversal Notices When Your Supplier Defaults on GST Payments...

Analysis of Amendments relating to Residential Dwelling and GTA Services” has been published in the NIRC Newsletter for the month of July, 2022

We are delighted to share that our article, “Analysis of Amendments Relating to Residential Dwelling and GTA Services,” has been...

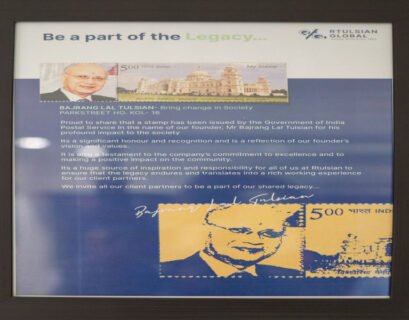

A Postal Stamp has been issued by Government of India Postal Service of our Mentor, Mr. Bajrang Lal Tulsian

🌟 Honoring a Visionary: Commemorative Postal Stamp for Mr. Bajrang Lal Tulsian 🌟 🚀 A Historic Tribute! The Government of India...

Valuation under Income Approach and its Preference during Covid-19 times” has been published in the ICMAI RVO June 2022 Journal, namely, “The Valuation Professional-Your Insight Journal.

We are pleased to announce that our article, “Valuation under Income Approach and its Preference...