Proposed Amnesty Scheme of conditional waiver of interest and penalty for F.Y.(s) 2017-18 to 2019-20” has been published in one of the leading Hindi newspapers in WB, Dainik Vishwamitra on 13.07.2024

We are delighted to announce that our article on the highly pertinent topic, “Proposed Amnesty...

Our views and expectations on taxation from the upcoming Union Budget 2024-25 have been published in one of the leading Hindi newspapers in West Bengal, Dainik Vishwamitra dated 18.07.2024

🔹 Featured in Dainik Vishwamitra – July 17, 2024 🔹 🚀 Breaking Down the Union Budget 2024-25: Taxation & Beyond! Our expert...

How to challenge penalty in case of belated payments to suppliers after 180 days from the date of invoice.

We are thrilled to share that our esteemed partner, FCA Ishan Tulsian, has authored an insightful article titled “How to Challenge...

How to value your business during COVID-19 times has been published in the House Journal of Association of Corporate Advisors& Executives (ACAE) of February, 2023

In the February 2023 edition of the House Journal by the Association of Corporate Advisors &...

How to value your business during COVID-19 Times Aspects to be considered’ has been published in the journal of ICAI RVO “The Valuation Perspective” in January 2023

In the February 2023 edition of the House Journal by the Association of Corporate Advisors & Executives (ACAE), we address one of the...

Analysis of EBITDA and Normalization of EBITDA” has been published in the Journal of May 2022 of ICMAI RVO, namely, “The Valuation Professional- Your Insight Journal

“Analysis of EBITDA and Normalization of EBITDA” We are delighted to announce that our article, “Analysis of EBITDA and Normalization...

Recipients need not reverse Input Tax Credit when suppliers have defaulted in payment of tax to the Government.

We are pleased to announce the publication of an insightful article in Dainik Vishwamitra, dated...

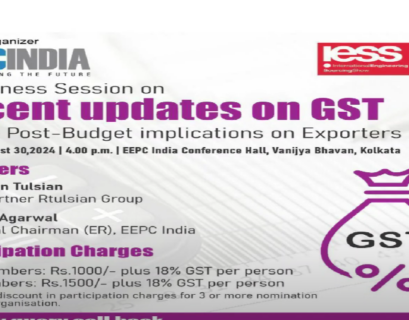

GST Updates & Post-Budget Impact on Exporters | EEPC India | Aug 30, 2024

Awareness Session on Recent GST Updates & Post-Budget Implications for Exporters Stay Ahead of GST Changes & Budget 2024 Updates...

GST Developments & Way Forward | EEPC India & OSSIA | Sept 11, 2024

The Engineering Export Promotion Council of India (EEPC India), in collaboration with the Orissa Small Scale Industries Association...

GST Financial Records Training-2 | NACIN Kolkata | Aug 14, 2024

Expert Training Session on “Reading and Understanding Financial Records from a GST...