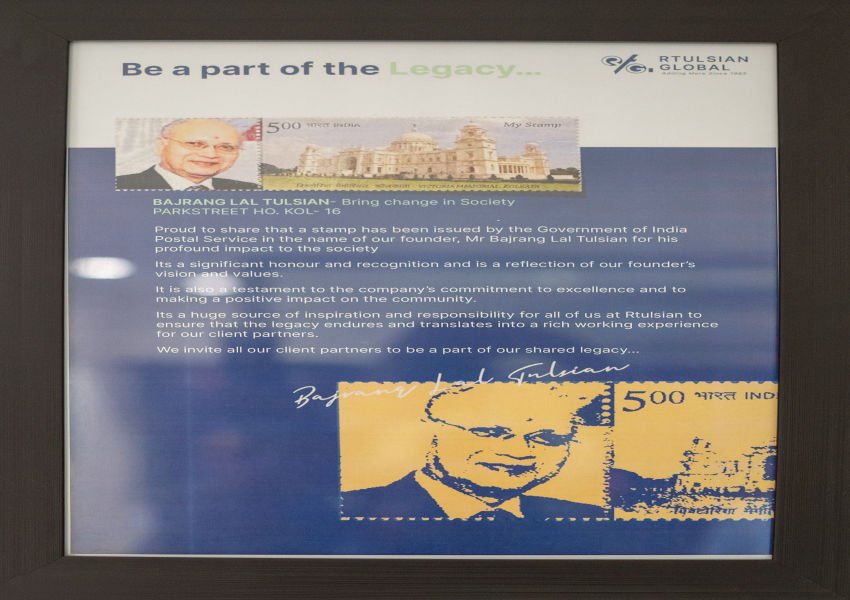

A Postal Stamp has been issued by Government of India Postal Service of our Mentor, Mr. Bajrang Lal Tulsian

🌟 Honoring a Visionary: Commemorative Postal Stamp for Mr. Bajrang Lal Tulsian 🌟 🚀 A...

Valuation under Income Approach and its Preference during Covid-19 times” has been published in the ICMAI RVO June 2022 Journal, namely, “The Valuation Professional-Your Insight Journal.

We are pleased to announce that our article, “Valuation under Income Approach and its Preference during Covid-19 Times,” has been...

Proposed Amnesty Scheme of conditional waiver of interest and penalty for F.Y.(s) 2017-18 to 2019-20” has been published in one of the leading Hindi newspapers in WB, Dainik Vishwamitra on 13.07.2024

We are delighted to announce that our article on the highly pertinent topic, “Proposed Amnesty Scheme for Conditional Waiver of Interest...

Our views and expectations on taxation from the upcoming Union Budget 2024-25 have been published in one of the leading Hindi newspapers in West Bengal, Dainik Vishwamitra dated 18.07.2024

🔹 Featured in Dainik Vishwamitra – July 17, 2024 🔹 🚀 Breaking Down the Union Budget...

How to challenge penalty in case of belated payments to suppliers after 180 days from the date of invoice.

We are thrilled to share that our esteemed partner, FCA Ishan Tulsian, has authored an insightful article titled “How to Challenge...

How to value your business during COVID-19 times has been published in the House Journal of Association of Corporate Advisors& Executives (ACAE) of February, 2023

In the February 2023 edition of the House Journal by the Association of Corporate Advisors & Executives (ACAE), we address one of the...

How to value your business during COVID-19 Times Aspects to be considered’ has been published in the journal of ICAI RVO “The Valuation Perspective” in January 2023

In the February 2023 edition of the House Journal by the Association of Corporate Advisors &...

Analysis of EBITDA and Normalization of EBITDA” has been published in the Journal of May 2022 of ICMAI RVO, namely, “The Valuation Professional- Your Insight Journal

“Analysis of EBITDA and Normalization of EBITDA” We are delighted to announce that our article, “Analysis of EBITDA and Normalization...

Recipients need not reverse Input Tax Credit when suppliers have defaulted in payment of tax to the Government.

We are pleased to announce the publication of an insightful article in Dainik Vishwamitra, dated June 19, 2024, that addresses a crucial...

GST Updates & Post-Budget Impact on Exporters | EEPC India | Aug 30, 2024

Awareness Session on Recent GST Updates & Post-Budget Implications for Exporters Stay Ahead of...